Citi to Acquire ING’s Custody and Securities Services Business in Central and Eastern Europe with €110 Billion in Assets Under Custody

Citi to Acquire ING’s Custody and Securities Services Business in Central and Eastern Europe with €110 Billion

26 Apr, 2013 15:53

ZIUA de Constanta

1148

Marime text

1148

Marime text

1148

Marime text

1148

Marime text

Bucharest – Citi Securities and Fund Services has entered in to a definitive agreement to acquire ING’s custody and securities services business in seven Central and Eastern European (“CEE”) markets currently representing €110 billion in assets under custody. ING is a premier provider of custody services in CEE, offering services to many of the world's largest financial institutions.

The transaction, which is subject to regulatory approval and clearances, includes ING’s local custody and securities services businesses in Bulgaria, the Czech Republic, Hungary, Romania, Russia, Slovakia and Ukraine. Once implemented, the addition of Bulgaria will extend Citi’s custody network coverage to over 95 markets and its proprietary custody network will be expanded to 62 markets.

The acquisition enables Citi to offer investors, intermediaries and issuers comprehensive securities services in the region through a strengthened country presence combined with access to Citi’s global banking network. The transaction will also provide clients with further processing efficiencies and enable consistency of service across multiple markets. Terms of the deal were not disclosed. Subject to standard closing conditions and regulatory approvals, Citi and ING expect this transaction to close in the first quarter 2014.

“ING was one of the first agents to identify the region’s rich opportunities, rapidly establishing an office network that provided unparalleled geographic coverage and local expertise,” said Neeraj Sahai, Head of Securities and Fund Services, Citi. “This

acquisition demonstrates our commitment to continually enhance our securities and fund services capabilities and extending our leadership position in emerging markets.”

“This transaction clearly confirms Citi’s long-term commitment to CEE and to our growing business in the region,” said Zdenek Turek, CEO Central & Eastern Europe, Citi. “It is an important investment which will further bolster our market position and create many synergies in this particular line of business, thus bringing substantial benefits to our customers.”

Through its Securities and Fund Services business, Citi’s industry-focused experts provide institutional issuers, intermediaries and investors worldwide with tailored solutions delivered through proven global platforms that feature modular, open architecture. With $13.5 trillion of assets under custody and the industry’s largest proprietary network, clients can leverage Citi’s local market expertise and global reach to extract value across the entire investment value chain.

###

About Citi

Citi, the leading global bank, has approximately 200 million customer accounts and does business in more than 160 countries and jurisdictions. Citi provides consumers, corporations, governments and institutions with a broad range of financial products and services, including consumer banking and credit, corporate and investment banking, securities brokerage, transaction services, and wealth management.

Additional information may be found at www.citigroup.com | Twitter: @Citi | YouTube: www.youtube.com/citi | Blog: http://blog.citigroup.com | Facebook: www.facebook.com/citi | LinkedIn: www.linkedin.com/company/citi

About Citi Transaction Services

Citi’s Transaction Services comprises Securities and Fund Services and Treasury and Trade Solutions, and is an integral part of Citi’s Institutional Clients Group. Transaction Services offers integrated cash management, trade and securities and fund services to multinational corporations, financial institutions and public sector organizations around the world. With a network that spans more than 97 countries, Citi’s transaction services supports over 75,000 clients. As of the first quarter of 2013, transaction services held on average $415 billion in liability balances and $13.5 trillion in assets under custody.

The transaction, which is subject to regulatory approval and clearances, includes ING’s local custody and securities services businesses in Bulgaria, the Czech Republic, Hungary, Romania, Russia, Slovakia and Ukraine. Once implemented, the addition of Bulgaria will extend Citi’s custody network coverage to over 95 markets and its proprietary custody network will be expanded to 62 markets.

The acquisition enables Citi to offer investors, intermediaries and issuers comprehensive securities services in the region through a strengthened country presence combined with access to Citi’s global banking network. The transaction will also provide clients with further processing efficiencies and enable consistency of service across multiple markets. Terms of the deal were not disclosed. Subject to standard closing conditions and regulatory approvals, Citi and ING expect this transaction to close in the first quarter 2014.

“ING was one of the first agents to identify the region’s rich opportunities, rapidly establishing an office network that provided unparalleled geographic coverage and local expertise,” said Neeraj Sahai, Head of Securities and Fund Services, Citi. “This

acquisition demonstrates our commitment to continually enhance our securities and fund services capabilities and extending our leadership position in emerging markets.”

“This transaction clearly confirms Citi’s long-term commitment to CEE and to our growing business in the region,” said Zdenek Turek, CEO Central & Eastern Europe, Citi. “It is an important investment which will further bolster our market position and create many synergies in this particular line of business, thus bringing substantial benefits to our customers.”

Through its Securities and Fund Services business, Citi’s industry-focused experts provide institutional issuers, intermediaries and investors worldwide with tailored solutions delivered through proven global platforms that feature modular, open architecture. With $13.5 trillion of assets under custody and the industry’s largest proprietary network, clients can leverage Citi’s local market expertise and global reach to extract value across the entire investment value chain.

###

About Citi

Citi, the leading global bank, has approximately 200 million customer accounts and does business in more than 160 countries and jurisdictions. Citi provides consumers, corporations, governments and institutions with a broad range of financial products and services, including consumer banking and credit, corporate and investment banking, securities brokerage, transaction services, and wealth management.

Additional information may be found at www.citigroup.com | Twitter: @Citi | YouTube: www.youtube.com/citi | Blog: http://blog.citigroup.com | Facebook: www.facebook.com/citi | LinkedIn: www.linkedin.com/company/citi

About Citi Transaction Services

Citi’s Transaction Services comprises Securities and Fund Services and Treasury and Trade Solutions, and is an integral part of Citi’s Institutional Clients Group. Transaction Services offers integrated cash management, trade and securities and fund services to multinational corporations, financial institutions and public sector organizations around the world. With a network that spans more than 97 countries, Citi’s transaction services supports over 75,000 clients. As of the first quarter of 2013, transaction services held on average $415 billion in liability balances and $13.5 trillion in assets under custody.

Urmareste-ne pe Grupul de Whatsapp

Comentarii

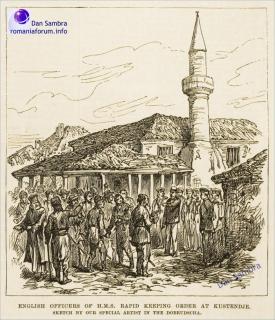

Fondul Documentar Dobrogea de ieri și de azi

Fondul Documentar Dobrogea de ieri și de azi

_thumb2.jpg)