BCR Operating performance improved by 19.8% in a still difficult economic environment

BCR: Operating performance improved by 19.8% in a still difficult economic environment

30 Jul, 2010 18:20

ZIUA de Constanta

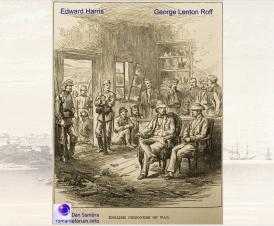

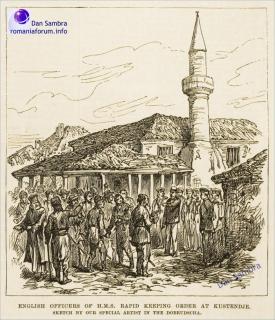

1865

Marime text

1865

Marime text

1865

Marime text

1865

Marime text

I. FINANCIAL Highlights FOR THE BCR GROUP1:

Good operating performance based on continued revenue generation and improved cost control

Operating result increased by 19.8% (or RON 269.9 million) on HY 2009 to RON 1,634.0 million (EUR 391.2 million) based on continued revenue generation and improved cost control. The improvement was mainly driven by the operating income growth (up by RON 183.6 million or 8.1% YOY) combined with a decrease in operating expenses (down by RON 86.3 million or 9.7% YOY) in the context of slight RON appreciation compared to HY 2009 (0.72% average rate appreciation against EUR in HY 2010 compared to HY 2009) and still high inflation rate. Net profit after taxes and minority interests amounted at RON 488.5 million (EUR 117.0 million) down by around 19.5% on HY 2009, mainly on much higher provision expense due the contracting economy heavily

impacting the market and BCR's customers demand.

Higher efficiency and improved risk management in a very challenging economic environment Cost-income ratio (CIR) improved to 32.9% from 39.5% in HY 2009. Return on equity (ROE) went down to 14.3% in line with expectations as the economic conditions remain tough. NPLs formation slowed down in HY 2010, with the improvement in the retail market balanced by an increase on the SME segment and micro-banking - the NPL coverage ratio stays comfortably at 128% (collateral and provisions). The NPL development caused Risk costs of RON 974.7 million, 24.5% higher on HY 2009, but declining compared to H2 2009.

Good operating performance based on continued revenue generation and improved cost control

Operating result increased by 19.8% (or RON 269.9 million) on HY 2009 to RON 1,634.0 million (EUR 391.2 million) based on continued revenue generation and improved cost control. The improvement was mainly driven by the operating income growth (up by RON 183.6 million or 8.1% YOY) combined with a decrease in operating expenses (down by RON 86.3 million or 9.7% YOY) in the context of slight RON appreciation compared to HY 2009 (0.72% average rate appreciation against EUR in HY 2010 compared to HY 2009) and still high inflation rate. Net profit after taxes and minority interests amounted at RON 488.5 million (EUR 117.0 million) down by around 19.5% on HY 2009, mainly on much higher provision expense due the contracting economy heavily

impacting the market and BCR's customers demand.

Higher efficiency and improved risk management in a very challenging economic environment Cost-income ratio (CIR) improved to 32.9% from 39.5% in HY 2009. Return on equity (ROE) went down to 14.3% in line with expectations as the economic conditions remain tough. NPLs formation slowed down in HY 2010, with the improvement in the retail market balanced by an increase on the SME segment and micro-banking - the NPL coverage ratio stays comfortably at 128% (collateral and provisions). The NPL development caused Risk costs of RON 974.7 million, 24.5% higher on HY 2009, but declining compared to H2 2009.

Business continued to grow in a weak economy

BCR preserved its market share supported by new business development in the corporate segment while retail lending slowed due the eligible demand constraints. The bank benefits from a strong liquidity and a sound capital base.

Urmareste-ne pe Grupul de Whatsapp

Comentarii

Fondul Documentar Dobrogea de ieri și de azi

Fondul Documentar Dobrogea de ieri și de azi

_thumb2.jpg)