Big spending predicted in 2012 for gold mining companies Rising gold prices, more acquisitions and further project development expected

Big spending predicted in 2012 for gold mining companies: Rising gold prices, more acquisitions and further project

19 Jan, 2012 13:37

ZIUA de Constanta

1258

Marime text

1258

Marime text

1258

Marime text

1258

Marime text

Bucharest, 19 January 2012. According to PwC's new annual Gold Price

Report, 80% of mining companies expect the price of gold to continue to

increase this year, with the majority of respondents expecting gold to

peak at US$2,000 per ounce in 2012.

Additionally, with 29% of respondents expecting to spend their cash on acquisitions this year and 40% of companies planning to replace reserves through acquisitions, it's evident that acquisitions remain on the minds of gold mining executives for 2012.

"With the volatility we are seeing in the market, not least of which includes the recent downturn in the gold price, those companies sitting on deep pools of cash and with an appetite for acquisition, are in the driver's seat. They are ready and able to swoop on smaller explorers who are more vulnerable to market fluctuations and have difficulty raising capital", stated Alexandru Lupea, Partner, Assurance Services, Energy, Utilities and Mining Industry Service Leader, PwC Romania.

In 2011, there were 544 gold acquisitions with an approximate value of US$11.2 billion. As of 30 November, the volume of acquisitions increased 12.6% and the value decreased 38.4% compared to the same period in 2010. In 2010, 483 acquisitions were completed with an approximate value of US$18.2 billion.

Impact of gold's price

Mining companies are struggling to reap the ultimate benefits of a high gold price - 62% of respondents reported that it was positively impacting their stock price, but the impact was less than expected.

In 2011, gold had risen by some 10%, but gold stocks within the S&P/TSX Global Gold Index had declined 9%.

"One main driver behind this unprecedented disparity between the price of gold and gold stocks is the recent rise in popularity of exchanged traded funds (EFT). Investors now have the choice of investing directly in gold mining companies or they can get exposure to the sector through ETFs, which provide a simple alternative", added Alexandru Lupea.

This disparity is having an impact on how executives plan to spend their increased cash flow:

27% made payments to dividends in 2011, a notable increase from only 9% in 2010

29% expect to spend their cash on acquisitions in 2012, up from 19% in 2011

Going the extra mile for investors

To provide an advantage to those investing in their companies rather than ETFs, many gold mining companies have started or increased dividends. As of November 2011, dividend payments for the top 20 gold mining companies were up 44% from 2010. In 2010, dividends only increased 18% from 2009.

"The rise in the dividend payout is another one for the history books and can be linked directly to the rising gold price. Linking the two benefits both the investor and management - not only does it give management extra firepower to be aggressive with dividend rates, they can do so without worrying about maintaining those levels if the gold price suffers a sharp decline. We expect gold companies will continue to explore ways to allow investors to get the benefit from the high prices. Gold-linked dividends are only one option; companies could get more creative with their dividend strategies", said Alexandru Lupea.

Foreign interest intensifies

Countries around the world are turning to gold to cope with volatile global financial markets and to instil investor confidence in their markets. Central banks' demand for gold has escalated to 148.8 tonnes since 2010.

The Bank of Korea is one example. In 2011, it made two major gold purchases - 25 metric tonnes in June and another 15 metric tonnes in November - the first it had done so since the 1997-1998 Asian financial crises.

"This is a trend we are seeing not only in developed economies, but emerging markets have also shown interest in boosting their gold holdings. We believe countries are now entering into a long-term period of gold accumulation. Given the relatively low amounts of gold available for purchase, countries with substantial foreign currency reserves that wish to diversify away from US dollars must do this gradually, in order to avoid destabilising the markets", concluded Lupea.

Notes to Editors

PwC's 2012 Gold Price Report assesses gold companies globally, with companies surveyed representing 26.5 million ounces of gold mined in 2011, and 37.75 million ounces to be mined in 2012.

For more information or to read the full 2012 Gold Price Survey, please visit: http://www.pwc.com/ca/goldsurvey

About PwC:

PwC firms help organizations and individuals create the value they're looking for. We're a network of firms in 158 countries with close to 169,000 people who are committed to delivering quality in assurance, tax and advisory services. Tell us what matters to you and find out more by visiting us at www.pwc.com/ro.

© 2011 PwC. All rights reserved.

PwC refers to the PwC network and/or one or more of its member firms, each of which is a separate legal entity. Please see www.pwc.com/structure for further details.

Additionally, with 29% of respondents expecting to spend their cash on acquisitions this year and 40% of companies planning to replace reserves through acquisitions, it's evident that acquisitions remain on the minds of gold mining executives for 2012.

"With the volatility we are seeing in the market, not least of which includes the recent downturn in the gold price, those companies sitting on deep pools of cash and with an appetite for acquisition, are in the driver's seat. They are ready and able to swoop on smaller explorers who are more vulnerable to market fluctuations and have difficulty raising capital", stated Alexandru Lupea, Partner, Assurance Services, Energy, Utilities and Mining Industry Service Leader, PwC Romania.

In 2011, there were 544 gold acquisitions with an approximate value of US$11.2 billion. As of 30 November, the volume of acquisitions increased 12.6% and the value decreased 38.4% compared to the same period in 2010. In 2010, 483 acquisitions were completed with an approximate value of US$18.2 billion.

Impact of gold's price

Mining companies are struggling to reap the ultimate benefits of a high gold price - 62% of respondents reported that it was positively impacting their stock price, but the impact was less than expected.

In 2011, gold had risen by some 10%, but gold stocks within the S&P/TSX Global Gold Index had declined 9%.

"One main driver behind this unprecedented disparity between the price of gold and gold stocks is the recent rise in popularity of exchanged traded funds (EFT). Investors now have the choice of investing directly in gold mining companies or they can get exposure to the sector through ETFs, which provide a simple alternative", added Alexandru Lupea.

This disparity is having an impact on how executives plan to spend their increased cash flow:

27% made payments to dividends in 2011, a notable increase from only 9% in 2010

29% expect to spend their cash on acquisitions in 2012, up from 19% in 2011

Going the extra mile for investors

To provide an advantage to those investing in their companies rather than ETFs, many gold mining companies have started or increased dividends. As of November 2011, dividend payments for the top 20 gold mining companies were up 44% from 2010. In 2010, dividends only increased 18% from 2009.

"The rise in the dividend payout is another one for the history books and can be linked directly to the rising gold price. Linking the two benefits both the investor and management - not only does it give management extra firepower to be aggressive with dividend rates, they can do so without worrying about maintaining those levels if the gold price suffers a sharp decline. We expect gold companies will continue to explore ways to allow investors to get the benefit from the high prices. Gold-linked dividends are only one option; companies could get more creative with their dividend strategies", said Alexandru Lupea.

Foreign interest intensifies

Countries around the world are turning to gold to cope with volatile global financial markets and to instil investor confidence in their markets. Central banks' demand for gold has escalated to 148.8 tonnes since 2010.

The Bank of Korea is one example. In 2011, it made two major gold purchases - 25 metric tonnes in June and another 15 metric tonnes in November - the first it had done so since the 1997-1998 Asian financial crises.

"This is a trend we are seeing not only in developed economies, but emerging markets have also shown interest in boosting their gold holdings. We believe countries are now entering into a long-term period of gold accumulation. Given the relatively low amounts of gold available for purchase, countries with substantial foreign currency reserves that wish to diversify away from US dollars must do this gradually, in order to avoid destabilising the markets", concluded Lupea.

Notes to Editors

PwC's 2012 Gold Price Report assesses gold companies globally, with companies surveyed representing 26.5 million ounces of gold mined in 2011, and 37.75 million ounces to be mined in 2012.

For more information or to read the full 2012 Gold Price Survey, please visit: http://www.pwc.com/ca/goldsurvey

About PwC:

PwC firms help organizations and individuals create the value they're looking for. We're a network of firms in 158 countries with close to 169,000 people who are committed to delivering quality in assurance, tax and advisory services. Tell us what matters to you and find out more by visiting us at www.pwc.com/ro.

© 2011 PwC. All rights reserved.

PwC refers to the PwC network and/or one or more of its member firms, each of which is a separate legal entity. Please see www.pwc.com/structure for further details.

Urmareste-ne pe Grupul de Whatsapp

Comentarii

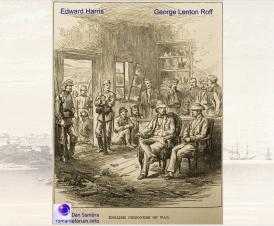

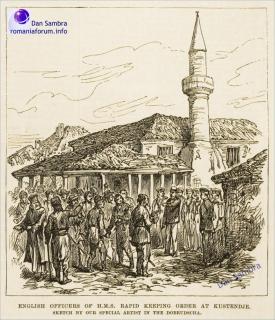

Fondul Documentar Dobrogea de ieri și de azi

Fondul Documentar Dobrogea de ieri și de azi

_thumb2.jpg)