Rompetrol Rafinare, T3 financial results

Rompetrol Rafinare, T3 financial results 1699

Marime text

1699

Marime text

Refining segment

Operational profit growth with 11,1 million USD in T3

18% drop in processing costs and 28% in administrative expenses in T3

The continuation of the sustainability and operation efficiency projects

Distribution segment

7% growth of the fueling points network (Rompetrol stations, Partener stations, Expres stations and internal bases)

Investments of over 1 million USD in the LPG cylinder renewal program

Petrochemicals sector

Positive operation results in T3 2010

15% drop in the level of general-administrative expenses, compared to T3 2009

Rompetrol Rafinare, company member of The Rompetrol Group, has recorded in T3 a consolidated turnover of approximately 953 million USD and a operational result (EBITDA) of 18 million USD, on the increase compared to approximately 4 million USD, result registered in the similar period of 2009.

In the period referred to, the company has improved with approx 50% its net result, up against the same period in 2009, it being further negative (from 40 million USD in T3 2009, to 20.5 million USD). These results come amid the positive evolution of certain indicators, specific to the oil industry (refining margin, oil products quotations) and the improvement of the operational activity of the company, at the same time being affected by the significant contraction of the market and of the internal macro-economical indicators (inflation rate, USD/EUR exchange rate).

The refining segment, Rompetrol Rafinare - the Petromidia refinery and the branch Vega Ploiesti, has registered in T3 a turnover of 774 million USD, a growth of 16% compared to 2009, as well as an improvement of over 11.1 million USD of the EBITDA, up to a negative level of 7.3 million USD.

Also, the net result obtained by the company in T3 has registered an improvement with 10.5 million USD, put side by side against the level recorded between July and September 2009, respectively 29.8 million USD, it being negative further on.

Amid the scheduled stop of the Petromidia refinery and the implicit decrease with 13% of the total quantity of processed raw material, up to a level of over 900.000 tons, the total fuel sales of the refining segment in T3 have risen up to 640.000 tons. Amongst those, the internal deliveries have decreased with 5%, while the external ones, with 16%.

Rompetrol Rafinare and Rompetrol Petrochemicals have interrupted their activity on 20th September, in order to carry out the works related to the general scheduled overhaul (maintenance works at 600 units and 2.000 pipes and subsequently their reauthorization, integration of over 400 new equipments).

The distribution segment, consisting of the following companies: Rompetrol Downstream, Rom Oil, Rompetrol Logistics and Rompetrol Gas, has registered between July and September a growth of 7% of the operational result (EBITDA), from 17.1 million USD in T3 2009, up to 18.4 million USD, amid an improvement of 1.3 million USD of the net result, up to a negative level of 7.4 million USD. At the same time, the turnover achieved increased to approximately 603 million USD, on the increase with 5% against the level registered in 2009.

The positive results achieved on this segment have been sustained by the optimization and the reduction of the logistics and distribution costs for the Rompetrol fuels, and also by the expansion with 7% of its own fueling point distribution network. Thus, at the end of September 2010, Rompetrol Downstream was operating a number of 797 fueling points (131 Rompetrol stations, 152 Rompetrol Partener stations, 161 Rompetrol Expres stations and 353 internal bases), to which 258 auto LPG distribution stations and over 6.000 gas cylinders are added.

In T3, Rompetrol Gas has assigned over 1 million USD for the continuation of the gas cylinder renewal program, the company finalizing the works at its new LPG bottling terminal in the County of Bacau, a total investment of over 11 million USD. At the same time, Rompetrol Downstream has finished the expansion/modernization works at a station located in Viilor, County of Constanta.

The companies within the distribution segment have succeeded in maintaining the sales level for petroleum products at figures similar to T3 2009 (393.000 tons), only a slight change being noticeable on the retail segment, while the wholesale segment stayed constant. Under the conditions in which the international quotations for fuel have are up by 16% for diesel and 7% for gasoline, Rompetrol Downstream has diminished in T3 its commercial margins by 14% on the retail segment while for the wholesale it registered an increase of 2%.

In terms of the petrochemical segment, represented by Rompetrol Petrochemicals, it generated a positive net profit result in Q3 (USD 2.7 million), compared to a negative value of 1.5 million USD in Q3 2009, compared to a 5% decrease in turnover, up to a level of 67 million USD. Meanwhile, the company improved its operating result (EBITDA) from 3 million USD to 6.1 million USD.

The positive net profit and the EBITDA were mainly supported by the increase of international quotations of petrochemical products, as well as the positive margins amid a decline of about 19% of sales.

Rompetrol Rafinare acquitted in August 71 million USD (51 million Euro) in account of the bonds issued by the company under the Convention concluded between Rompetrol Rafinare and the Ministry of Finance in December 2003. Besides this amount, the company has paid in the period 2004 - 2010 accrued interest on bonds totaling over 250 million USD. (182.4 million Euro)

According to the legal and contractual requirements (GEO 118/2003 and Convention) the bonds unredeemed until the due date (September 30, 2010) were converted into shares. Following this operation, the amount by which the share capital was increased, was directly awarded to the Romanian State duly represented by the Ministry of Public Finance, which became a shareholder of the Company, holding an interest of 44.6959% of the aggregate value of the company's share capital, and also represented a capital increase (in equal amount) offered for subscription to the shareholders existing on the registration date, Octomber 18, 2010.

The company continued in the first nine months of the year to be an important contributor to the Romanian state budget, the total contribution to central and local budgets amounted to approximately 1.2 billion USD, an increase of 70% as the same period last year. In the first nine months of this year, Rompetrol Rafinare's total exports, together with its subsidiaries Rompetrol Gas and Rompetrol Petrochemicals, have reached over USD 774 million, an increase of 10% over the same period in 2009.

* The consolidated financial statements of Rompetrol Rafinare include the results of Rompetrol Rafinare S.A. and those of its subsidiaries, Rompetrol Petrochemicals S.R.L., Rom Oil S.A., Rompetrol Downstream S.R.L. and Rompetrol Logistics S.R.L. (together with the subsidiary Rompetrol Gas S.R.L.)

** The figures presented herein are consolidated and not audited and the reporting was in compliance with International Financial Reporting Standards (IFRS).

Department of Communication and Corporate Affairs, Rompetrol

Urmareste-ne pe Grupul de Whatsapp

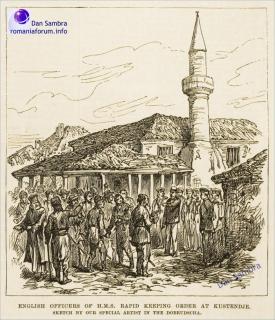

Fondul Documentar Dobrogea de ieri și de azi

Fondul Documentar Dobrogea de ieri și de azi

_thumb2.jpg)