The current global debates about the international tax system create an opportunity for change

The current global debates about the international tax system create an opportunity for change

09 May, 2013 12:27

ZIUA de Constanta

1113

Marime text

1113

Marime text

1113

Marime text

1113

Marime text

News release

Date 9 May 2013

The current global debates about the international tax system create an opportunity for change

PwC welcomes and supports recent actions from the Romanian Government to use fiscal measure to improve the international attractiveness of Romania, including by implementing a comprehensive holding legislation

Bucharest, 9 May 2013. Concern that global corporations are avoiding paying their “fair share” of taxes has recently gained considerable attention from governments, multinational organisations and the media, which created an opportunity for an overhaul of the tax system, but PwC warns against new regulations that disregard the realities of today’s economy.

A recent report of the OECD - Addressing Base Erosion and Profit Shifting – issued a series of recommendations that, if implemented, will result in a significant overhaul of the international tax system. These may involve stricter rules for setting-up holding structures, changes in the global financing flows or the revision of the principles for allocating the taxing rights between various jurisdictions. These possible repercussions were presented today in a tax conference organized by PwC Romania.

“The present international tax legislation dates from the 1960s and 1970s and is obviously not suited to today’s business activities where electronic and cross-border trade became common, while the intellectual property plays a fundamental role in commercial arrangements between companies.

We believe that a comprehensive reform of the tax laws and treaties is needed around the world, in order to create a balanced, modern and effective tax system. On the other hand, one can’t ignore the fact that in today’s global market, taxes have become a competitive cost and multinational corporations have a legitimate need to optimize this cost in order to face up to their competitors and maximize shareholder’s value”, states Peter de Ruiter, Partner, Tax and Legal Services Leader, PwC Romania.

“Transparent information sharing between governments can help with the issue of tax avoidance. Governments must do their part to encourage full compliance with the tax legislation, and should direct their tax audit resources toward the most likely points of evasion, while actively pursuing electronic information that allows verification of the income which is reported by individuals against the other available information. From our point of view this debate will lead to an increased attention from tax authorities and legislators all over the world on substance, transparency and exchange of information.”, adds Mihaela Mitroi, Tax Partner, PwC Romania.

“Yet this volatile international environment creates also opportunities for Romania to position itself as an attractive holding destination if it enacts a comprehensive holding legislation that will attract capital in the country”, concluded Mihaela Mitroi.

About PwC

PwC helps organisations and individuals create the value they’re looking for. We’re a network of firms in 158 countries with more than 180,000 people who are committed to delivering quality in assurance, tax and advisory services. Tell us what matters to you and find out more by visiting us at www.pwc.com/ro

PwC refers to the PwC network and/or one or more of its member firms, each of which is a separate legal entity. Please see www.pwc.com/structure for further details.

© 2013 PwC. All rights reserved.

Date 9 May 2013

The current global debates about the international tax system create an opportunity for change

PwC welcomes and supports recent actions from the Romanian Government to use fiscal measure to improve the international attractiveness of Romania, including by implementing a comprehensive holding legislation

Bucharest, 9 May 2013. Concern that global corporations are avoiding paying their “fair share” of taxes has recently gained considerable attention from governments, multinational organisations and the media, which created an opportunity for an overhaul of the tax system, but PwC warns against new regulations that disregard the realities of today’s economy.

A recent report of the OECD - Addressing Base Erosion and Profit Shifting – issued a series of recommendations that, if implemented, will result in a significant overhaul of the international tax system. These may involve stricter rules for setting-up holding structures, changes in the global financing flows or the revision of the principles for allocating the taxing rights between various jurisdictions. These possible repercussions were presented today in a tax conference organized by PwC Romania.

“The present international tax legislation dates from the 1960s and 1970s and is obviously not suited to today’s business activities where electronic and cross-border trade became common, while the intellectual property plays a fundamental role in commercial arrangements between companies.

We believe that a comprehensive reform of the tax laws and treaties is needed around the world, in order to create a balanced, modern and effective tax system. On the other hand, one can’t ignore the fact that in today’s global market, taxes have become a competitive cost and multinational corporations have a legitimate need to optimize this cost in order to face up to their competitors and maximize shareholder’s value”, states Peter de Ruiter, Partner, Tax and Legal Services Leader, PwC Romania.

“Transparent information sharing between governments can help with the issue of tax avoidance. Governments must do their part to encourage full compliance with the tax legislation, and should direct their tax audit resources toward the most likely points of evasion, while actively pursuing electronic information that allows verification of the income which is reported by individuals against the other available information. From our point of view this debate will lead to an increased attention from tax authorities and legislators all over the world on substance, transparency and exchange of information.”, adds Mihaela Mitroi, Tax Partner, PwC Romania.

“Yet this volatile international environment creates also opportunities for Romania to position itself as an attractive holding destination if it enacts a comprehensive holding legislation that will attract capital in the country”, concluded Mihaela Mitroi.

About PwC

PwC helps organisations and individuals create the value they’re looking for. We’re a network of firms in 158 countries with more than 180,000 people who are committed to delivering quality in assurance, tax and advisory services. Tell us what matters to you and find out more by visiting us at www.pwc.com/ro

PwC refers to the PwC network and/or one or more of its member firms, each of which is a separate legal entity. Please see www.pwc.com/structure for further details.

© 2013 PwC. All rights reserved.

Urmareste-ne pe Grupul de Whatsapp

Comentarii

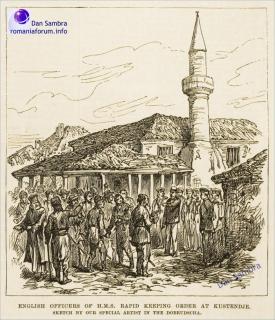

Fondul Documentar Dobrogea de ieri și de azi

Fondul Documentar Dobrogea de ieri și de azi

_thumb2.jpg)