Wave of new regulation tops insurance sector risks - ‘Banana Skins' poll pinpoints key concerns for insurers

Wave of new regulation tops insurance sector risks - ‘Banana Skins' poll pinpoints key concerns for insurers 1637

Marime text

1637

Marime text

The CSFI's latest Insurance Banana Skins survey, conducted in association with PwC, says that new rules governing issues such as solvency and market conduct could swamp the industry with costs and compliance problems. It could also distract management from the more urgent task of running profitable businesses at a time when the industry is already under stress.

The survey polled nearly 500 insurance practitioners and industry observers in 40 countries to find out where they saw the greatest risks over the next 2-3 years. Regulatory risk emerged a clear leader in all major markets, including North America, Europe, Middle East/Asia and the Far East/Pacific.

The EU's Solvency II Directive, due for implementation by the end of this year, was the focus of strongest concern. But the survey also identified new international reporting standards, the UK's review of retail distribution practices and other tax and regulatory initiatives as swelling a heavy agenda.

Other high-ranking concerns revealed by the survey include the availability of capital to meet tougher regulatory requirements, and the uncertain state of the world economy and financial markets. These are adding to the pressures on an industry which is being squeezed by low interest rates and intense competition.

A strong riser in this year's ranking of 26 risks was the incidence of natural catastrophes, a reaction to recent disasters in New Zealand and Japan. Also rising strongly is political risk, a consequence of events in the Arab world, plus growing concerns about the solvency of eurozone countries. A new entrant is the shortage of talent which emerged as a major issue in all regions.

On the other hand, a number of risks have fallen in urgency, among them the use of complex instruments which created difficulties for insurance companies during the financial crisis. The industry's capacity to manage risk is also seen to have improved.

Despite a high incidence of floods, bombings and oil spills over the last couple of years, concern about climate change, terrorism and pollution risks remains low. These are seen to be manageable underwriting risks, and less threatening to the insurance business than regulatory change.

"These results show an industry which is being pressed on many sides at once, and will need skilled management to get through. It is not clear whether new regulation is helping or hindering it", stated David Lascelles, survey editor.

"Insurers' attention has clearly changed with much more focus on how to deal with the increasing regulation they face. This is potentially distracting key resources and talent away from opportunities to grow their business. To gain a competitive advantage, insurers need to move the regulatory burden away from a box-ticking exercise to something that is embedded in the business and used to manage the changing risk profile. All this is set against a challenging backdrop of increased natural catastrophes, low interest rates and uncertain world economy", said David Law, global Insurance Leader at PwC.

„According to the results of the Quantitative Impact Study 5 report, the impact of the implementation of Solvency II in Romania on the capital requirements of local insurance companies will not be a significant one. However, the implementation of the Directive will require changes to the current business models, reviewing corporate governance practices, risk management systems, reporting and data quality. Insurance companies that are part of large international groups have already launched the process of Solvency II implementation and are currently in different stages of progress. For independent insurance companies operating in Romania however, Solvency II implementation can represent a significant challenge", added Dan Iancu, Partner, Financial Services Industry Group Leader, PwC Romania.

A breakdown of the insurance industry by sector shows the life side specifically concerned about the impact of low interest rates on investment performance, and the task of managing complex and competitive retail distribution networks. On the non-life side, the main concerns are with excess capacity and competitive pricing, along with the impact of surging catastrophe claims. Concerns in the reinsurance sector are mainly with the security of capacity in a highly competitive market.

Notes to Editors:

1. For further information please contact David Lascelles, CSFI, on +44 (0)20 7493 0173 or +44 (0)7710 088658, or Ruxandra Băndilă, Director, Marketing, Communication and Business Development, PwC Romania, on 021 225 35 00, or ruxandra.bandila@ro.pwc.com.

2. The Insurance Banana Skins survey was conducted in March and April 2011 and is based on 490 responses from 40 countries. The breakdown by type of respondent was:

|

% |

|

|

Life insurance |

29 |

|

Non-life |

29 |

|

Composite |

11 |

|

Reinsurance |

6 |

|

Brokers |

6 |

|

Observers |

19 |

3. The survey is the latest in the CSFI's long-running Banana Skins series on financial risk. Previous Insurance banana Skins surveys were in 2007 and 2009.

4. The CSFI (Centre for the Study of Financial Innovation) is a non-profit think-tank, founded in 1993, which looks at challenges to and opportunities for the financial sector. It has an affiliate organisation in New York, the New York CSFI.

5. PwC firms provide industry-focused assurance, tax and advisory services to enhance value for their clients. More than 161,000 people in 154 countries in firms across the PwC network share their thinking, experience and solutions to develop fresh perspectives and practical advice. See pwc.com for more information.

Urmareste-ne pe Grupul de Whatsapp

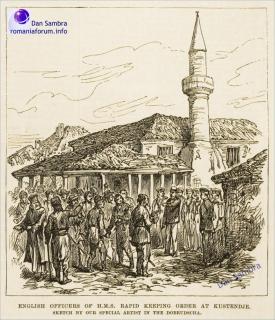

Fondul Documentar Dobrogea de ieri și de azi

Fondul Documentar Dobrogea de ieri și de azi

_thumb2.jpg)